Successful content creators do very well financially because of the high volume of users clicking on their productions and works. When the viewing population rises, so does the creator’s capacity to earn significant money from a venture. This income is, of course, taxable by the U.S. Internal Revenue Service (IRS), and the creative talent gets less to spend and save. However, the tax code allows for some powerful deductions to minimize taxable income, and here are the best tax deductions for content creators.

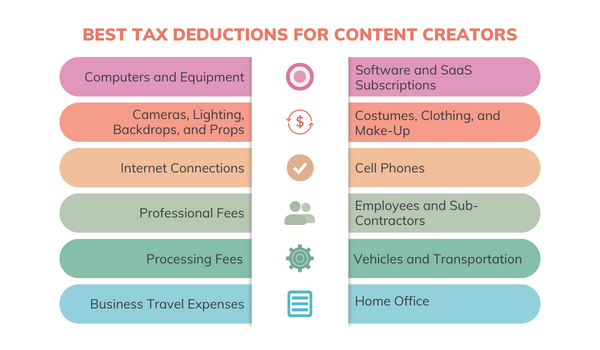

Common Tax Deductions for Content Creators

Content producers are often sole proprietors or S-corporations working from home. Therefore, they depend on technology to design and generate their work and then get it out in front of the public. Here are some of the best tax deductions for content creators for which they may qualify.

Computers and Equipment

Online writers, videographers, performers, and other artists can, in fact, deduct the cost of computer hardware. Yet there is a caveat to this allowance: the deduction only applies to use for business purposes. This means that if the equipment also serves personal use objectives, entertainment, paying household bills, emailing friends, etc., then only a portion is eligible for deduction. The business-related activity must account for 50 percent of total usage. The IRS provides formulas to taxpayers for determining the exact percentages. Obviously, having dedicated computers for work makes it easier.

Software and SaaS Subscriptions

Software installed on a computer and cloud-based software, i.e., Software as a Service (SaaS), is entirely deductible, provided the user demonstrates its applicability to creating content. SaaS subscriptions have allowed creators to generate more content without the time and cost of buying software, additional memory, downloading it, and waiting for its next updates. Either way, you can write off these costs legally.

Cameras, Lighting, Backdrops, and Props

Almost everything related to staging and filming is 100 percent deductible. So, for example, if you have a dedicated set for videos, that furniture is a write-off if you bought it for that purpose. Likewise, the camera, light fixtures, microphones and other elements necessary to produce content are also eligible for tax write-offs.

Costumes, Clothing, and Make-Up Tax Deductions for Content Creators

Clothing is more challenging to deduct since most of it is usable outside your content platform. However, if there is a unique design created for an online personality or role, its cost might be a deductible item. Make-up, too, may represent a work necessity for video content makers if it is specifically identified with a character or influencer.

Internet Connections

Like computers, internet connections are available for both creative and personal pursuits. So, the allotment of work time versus individual time will determine the amount of internet cost eligible for deduction from taxable income.

Cell Phones

Phone use in the service of business interests is deductible. The price of a cell phone used exclusively for business is deductible in full. Meanwhile, a phone that doubles as a personal device is subject to taxation. Experts recommend obtaining an itemized phone bill to discern how much time is spent on personal matters instead of business.

Professional Fees

As YouTube and social media participation with your output increase, you may need to retain professionals. e.g., lawyers, accountants, and consultants, to supervise budgets and make sure you are conforming to laws related to intellectual property and speech. Retainers and charges for such services are tax-deductible.

Employees and Sub-Contractors

The growth of a channel and diversification of media can also require additional help from various vendors and even paid employees. For example, you can pay camera operators, set designers, and designers (to name a few), provided you report it correctly, which is also a deductible expense.

Processing Fees

The more payment methods you accept, the more processing fees you incur. Credit and debit card companies see content creators as merchants and will ding them for every transaction. Typically, these fees amount to between one and three percent of the transaction amount. This is an area where setting yourself up as a legal business entity is advisable because businesses can withhold these fees from taxable income.

Vehicles and Transportation

The consumption of fuel, or electrical charge, for the business can be partially deducted when the trip is to advance the content platform: a personal appearance, for example. However, unless a vehicle is only for the sole use of your business enterprise, you can only deduct state and local sales tax.

Business Travel Expenses

Hotel/motel bills are usually tax-deductible for business travel. The same applies to meals when on the road, within reason. A ribeye steak might get an OK from the IRS. Caviar? Not so much.

Home Office Tax Deductions for Content Creators

Working out of the house has numerous advantages, such as no commutes, a flexible schedule, and presence in the event of an emergency at home, to name a few. There is also the tax benefit, i.e., the home office deduction. Most online content creators work from home and can qualify for the home office deduction. This helps the creator to offset any expenses that working out of the house entails. The benefit is not automatic, however.

- You must use the workspace consistently and exclusively for the business.

- The management and administration of the business must take place at home.

A content creator, accordingly, might perform or do research off-site, but the house serves as the hub of the business. The IRS caps the amount of workspace at 300 square feet. In 2021, the deduction rate was five dollars per square foot. Be very detailed in documenting expenses like mortgage payments, property tax, utility charges, insurance premiums, and repair costs. These are each eligible for deduction.

Final Thoughts on the Best Tax Deductions for Content Creators

The above are things to consider when considering taxes and content creation. But, again, an accountant or tax advisor like Only Taxes can fill in the details, even in a complimentary consultation. The point is that content creators are legitimate businesses and are treated as such by the IRS. Contact Only Taxes to schedule your complimentary accounting consultation.